Creating a budget is one of the best ways to keep your finances on track. With a budget, you can easily track your income and expenses and make sure you’re staying on track with your financial goals. However, creating a budget can be intimidating for some people. Here are some tips to help you get started.

Set Your Goals

Before you start creating a budget, it’s important to set some financial goals. What do you want to achieve? Do you want to save for a house, pay off debt, or build up your emergency fund? Once you have an idea of your goals, you can begin creating your budget.

Track Your Income and Expenses

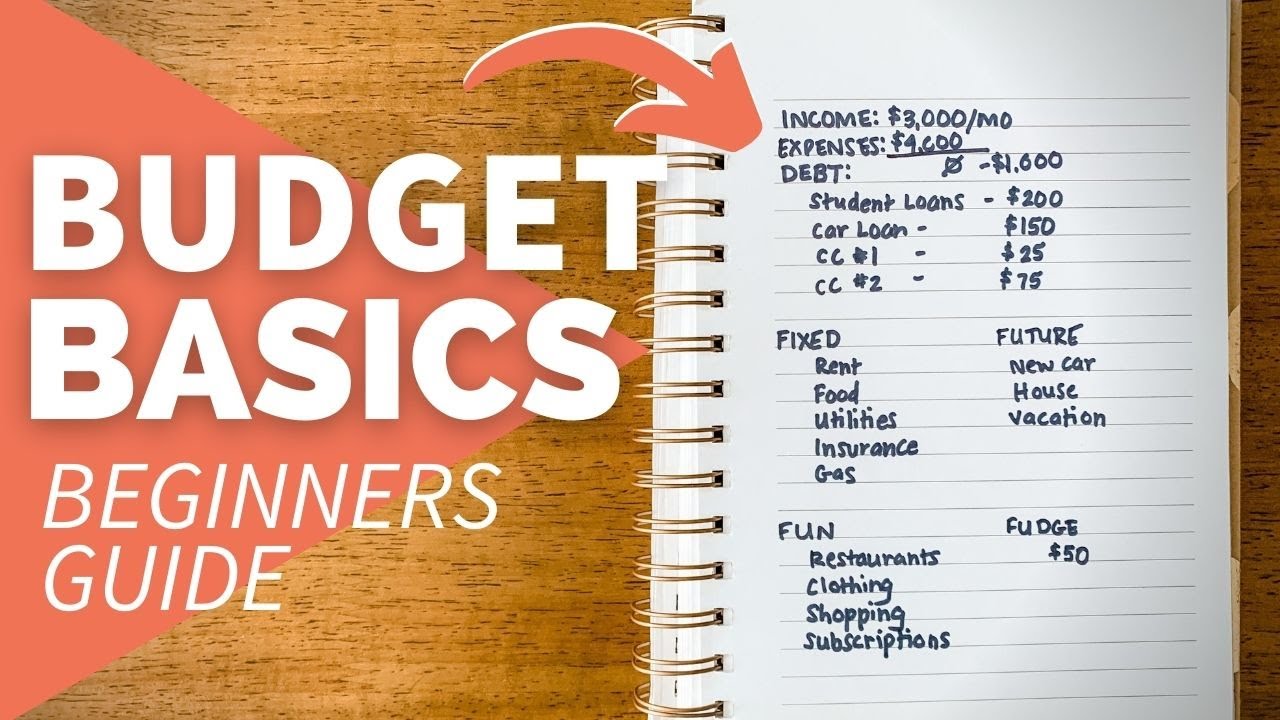

The next step is to track your income and expenses. This will help you understand where your money is going and how much you have available to save or spend. Start by listing all of your sources of income, such as your salary, investments, and any other sources. Then, list your expenses. This includes bills, groceries, and other day-to-day expenses. You can also use a budgeting app to help you track your income and expenses.

Set a Budget

Once you have an idea of your income and expenses, you can start setting a budget. Start by allocating your income to cover your expenses. For example, if your income is $2,000 a month, you may want to allocate $1,000 for rent, $400 for groceries, and $200 for other expenses. You can also use budgeting apps to help you allocate your income and track your spending.

Adjust Your Budget

Your budget is not set in stone. As your income and expenses change, you may need to adjust your budget. For example, if your rent increases, you may need to adjust your budget to account for the higher expense. You should also regularly review your budget to make sure you’re staying on track with your financial goals.

Stay on Track

Creating a budget is the first step in managing your finances. But it’s important to stay on track with your budget. Make sure you’re tracking your income and expenses and adjusting your budget as needed. You should also review your budget regularly to make sure you’re staying on track with your financial goals.

Tips for Sticking to Your Budget

- Set realistic goals – It’s important to set realistic goals when creating a budget. If your goals are too ambitious, you may find yourself struggling to stay on track.

- Track your progress – Tracking your progress is a great way to stay motivated and stay on track with your budget. You can use budgeting apps to track your progress and make sure you’re staying on track.

- Be flexible – Your budget is not set in stone. As your income and expenses change, you may need to adjust your budget. Be flexible and make changes as needed.

Creating a budget is a great way to manage your finances and stay on track with your financial goals. With the right budgeting tools and a bit of discipline, you can easily create and stick to a budget that works for you.