Developing financial projections is an important part of any business planning and strategy. It is a process of estimating and predicting future financial performance and activities of a business. Financial projections are essential for investors and lenders to assess the risk and potential of a business. A well-thought-out financial projection helps to assess the viability of a business and its ability to generate profits and cover expenses.

Steps to Develop Financial Projections

Developing financial projections involves a number of steps and can be a complex process. Here are the steps that need to be taken to develop financial projections:

- Gather Historical Financial Data: The first step is to gather historical financial data of the business, such as balance sheets, income statements, and cash flow statements. This will help to identify trends in the business and to understand the financial health of the business.

- Define Objectives and Goals: The next step is to define the objectives and goals of the business. This includes defining the financial goals, such as sales targets, profitability targets, and cash flow targets.

- Identify Assumptions and Risks: It is important to identify the assumptions and risks associated with the financial projections. This includes assumptions about the industry, the economy, the competition, and other factors that may affect the financial performance of the business.

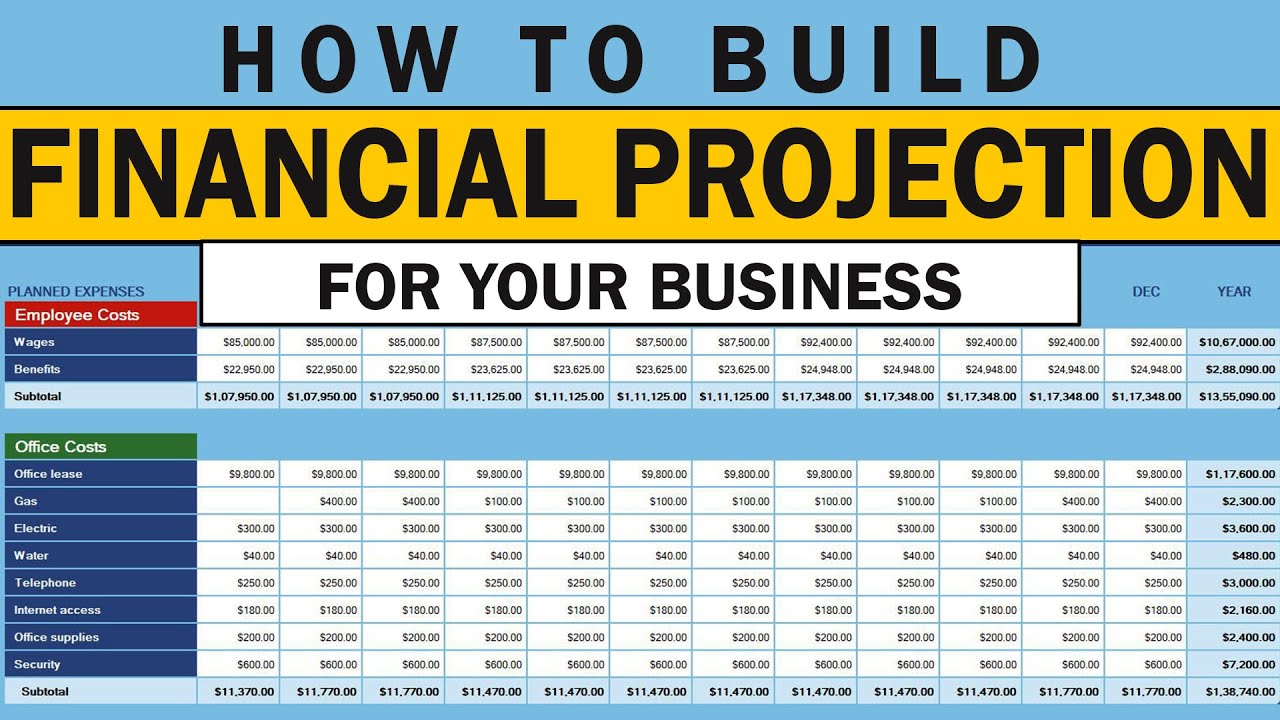

- Develop Financial Model: Once the objectives and assumptions have been identified, the next step is to develop a financial model. This model should include all the assumptions, goals, and risks that have been identified. It should also include projections for sales, expenses, profits, and cash flow.

- Analyze Results: Once the financial model has been developed, the results should be analyzed. This includes assessing the accuracy of the assumptions and evaluating the potential risks and rewards associated with the financial projections.

- Update Financial Projections: It is important to update the financial projections on a regular basis. This includes updating the assumptions and goals, and making any necessary changes to the financial model.

Benefits of Developing Financial Projections

Developing financial projections can be a complex and time-consuming process, but it is an essential part of any business planning and strategy. The benefits of developing financial projections include:

- Identifying Risks and Opportunities: Financial projections can help to identify potential risks and opportunities that may not be evident otherwise. This can help to inform decisions about the future of the business.

- Planning for the Future: Financial projections can help to plan for the future of the business. This includes setting goals and objectives, and identifying potential areas for growth and improvement.

- Assessing Viability: Financial projections can help to assess the viability of a business and its ability to generate profits and cover expenses. This can be useful for potential investors and lenders.

- Making Decisions: Financial projections can help to make informed decisions about the future of the business. This includes decisions about investments, marketing strategies, and other aspects of the business.

Conclusion

Developing financial projections is an important part of any business planning and strategy. It is a process of estimating and predicting future financial performance and activities of a business. Financial projections are essential for investors and lenders to assess the risk and potential of a business. A well-thought-out financial projection helps to assess the viability of a business and its ability to generate profits and cover expenses.